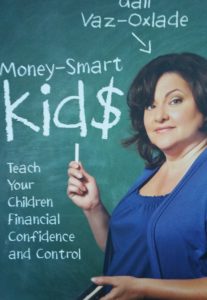

Last Tuesday evening, I attended TV personality, Gail Vaz-Oxlade’s, talk on raising “Money-Smart Kid$”. There were many valuable “take-aways” from her presentation with my biggest “take-away” being the importance of giving kids/teens an allowance to teach further responsibility.

How Does Giving Kids an Allowance Increase Independence and Responsibility?

As with all jobs, it is often easier to just do it ourselves than to give the responsibility to someone else, especially a child. It’s easier to tie children’s shoelaces than it is to ask them to do it, but at some point we realize that they’re capable and it’s important that they figure out how to do it.

Allowance is the same! It’s easier for us to buy their clothes, buy presents for birthday parties and put some of our children’s birthday money in their savings account, but doing it all for them, takes away the learning opportunities! The younger they learn to manage their money, the better life skills they will have for staying out of debt and making wise investments. Children need their parents to teach them how to manage money and they need lots of practice at these skills.

The idea of an allowance is to put some of the money you routinely spend on your child directly into their hands so that they can learn how to manage it for themself. It’s about transferring responsibility for financial decision-making to your child so that they can get some practice….Over time, even a modest allowance will get kids thinking about the value of money and how to make their dollars go further.

~ Gail Vaz-Oxlade

What’s the Best Way to Implement an Allowance?

- Set expectations for what kids will do with their money (create guidelines)

- Divide allowance into three components: 1) the part to be saved 2) the part to be shared 3) the part to be spent (spending on a whim/”mad money” and planned spending)

- Set up four jars and have them label them: Savings, Sharing, Planned Spending, Mad Money (The jars makes it concrete – when there’s no more money left in the Mad Money jar, there’s no more money to spend until the next month’s allowance)

How Much for Allowance?

A rough guide for children ages 6-10 yrs. = the child’s age per week. For example, an 8 year old would get $8 per week = $32 per month. For younger children, it’s more meaningful and easier to handle if it’s given on a weekly basis.

$32 per month for an 8 year old may seem like a lot, but remember that there needs to be enough for the child to divide it into savings, sharing, and spending. Also, as the allowance increases each year, so do the items that will now come out of their money, such as school supplies, clothing (start with inner and move to outer-wear), and gift giving.

Discuss with your child, when they think would be the best day to receive it and remain consistent – put a reminder in your phone as your child shouldn’t have to ask for his/her allowance. Give the allowance in smaller denominations so it makes it easier to divide it up into the jars as soon as they receive it.

How Much For Each Jar?

In general, Gail recommends:

- 10% of your income (allowance) for savings

- 5% of your income (allowance) for sharing with those less fortunate

- variable % for spending, as it depends on what your expectations will be as to what comes out of their money and it depends on what item they might be saving for

Should Allowance Be Connected to Chores and School Work or Grades?

No, no, and no!

Chores are what each family member does as part of their responsibility in the family. (If it’s an above and beyond job and the child is trying to earn extra money, then it’s okay to pay them for something you might hire someone else to do, such as rake the leaves, wash the car, shovel the snow etc.)

Doing well in school should be an internalized experience of feeling proud, knowing that the hard work has been worth the effort vs. being connected to an external monetary reward.

*Also, any paying job should be a supplement to allowance, a child shouldn’t be punished for getting a job by having their allowance taken away.

Natural and Logical Consequences with Allowance

Having to create one’s own budget, also allows the opportunity for natural and logical consequences to occur. If one has spent all of their monthly spending money on an expensive piece of clothing and now has no money left to go out for dinner with their friends, DON’T rescue, the money is gone and your child needs to experience this. If your child is driving your car and dings the door, it’s up to them to use their money to repair it.

Since clothing can be a source of contention, between parents and youth, you may decide to buy your child one outfit per season for the family celebration get-togethers or other special events, to avoid the ripped jeans and too small shirt for Grandma’s special birthday party!

“Return Responsibility to the Child”

Giving an allowance is an excellent tool for teaching many life skills such as:

- self-discipline

- organization

- planning

- problem-solving

- value for money

- responsibility

- budgeting

- living within one’s means

Remember that the objective of giving an allowance is to teach all of the above skills, and not to use it for punishment, reward and other external control reasons.

For more step-by-step information on giving an allowance, Gail’s book, Money-Smart Kid$ is a quick and easy read for $6.99 (available at 32 Books in Edgemont Village, North Vancouver and Amazon etc.)

These are the steps to creating a new debt-free generation, who understand the value of money and how to live within their means.

Warmly,

Want to Connect?

Subscribe now to receive free weekly parenting tips and inspiration.